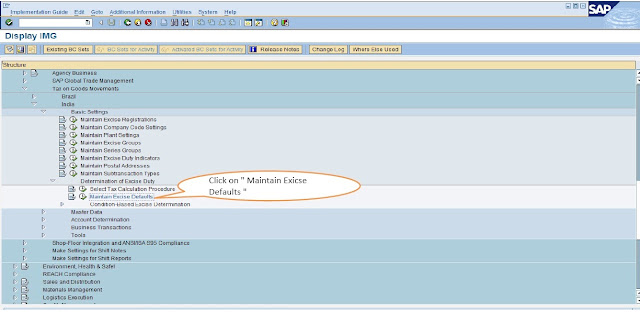

STEP 1: Following is the path For to Maintain the EXCISE DEFAULTS

- IMG activity path :IMG > LOGISTIC GENERAL > TAX ON GOODS MOVEMENT > INDIA > BASIC SETTINGS > DETERMINATION OF EXCISE DUTY > MAINTAIN EXCISE DEFAULTS

- Transaction code : SPRO

STEP 2: Click on execute button to Maintain the MAINTAIN EXCISE DEFAULTS

STEP 3: Then Click on New Entry to Maintain CVD Cond & Other depending upon Tax procedure ( Following type Window will Open)

Here we define which tax procedure and pricing condition types are used in calculating excise taxes using formula-based excise determination.

If we use condition-based excise determination, we have to fill only the CVD cond. field. & all other field will be be blank.

CVD Condition :

Specifies the condition type used for countervailing duty on imports. A

form of excise duty imposed on imports that are subsidized by country

in which they were manufactured. CVD has been explained in detail in

one of the one above screen .

If you use Formula Based Excise Determination fill out the field as

follow:

- Enetr Tax Procedure & Pricing Condition that are Relevant for exicse Tax procedure.

- Specify the purchasing & sales Condition types used for BED, AED,SED,Cess.

- Specify the condition type fron Sales order that are used for exciserates .

- Specify CVD condition type for Import .

STEP 4 : Click on Save Button to store Configured data

0 comments:

Post a Comment